Your provincial tax rate is determined by where you live after each fiscal year, which is generally December 31st. It makes no difference if you spent the year in another (or numerous) provinces; the rate you are charged is dependent on your province or territory of residence on the last day of the year.

Combining provincial and federal income taxes yields the total amount of income tax that each Canadian must pay. You may calculate your federal taxes first, then your provincial taxes, and then sum them all up to get the total.

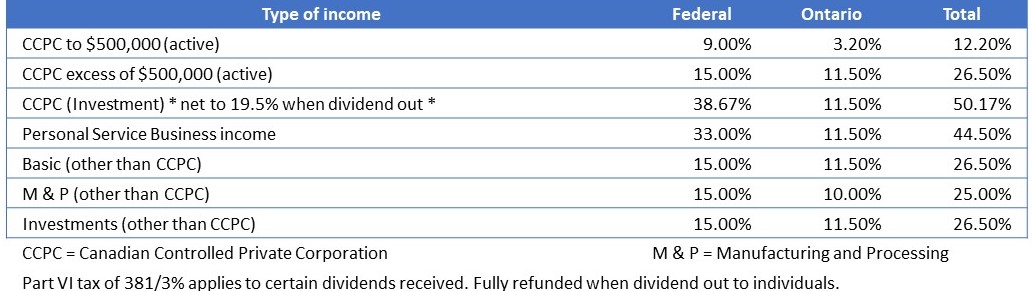

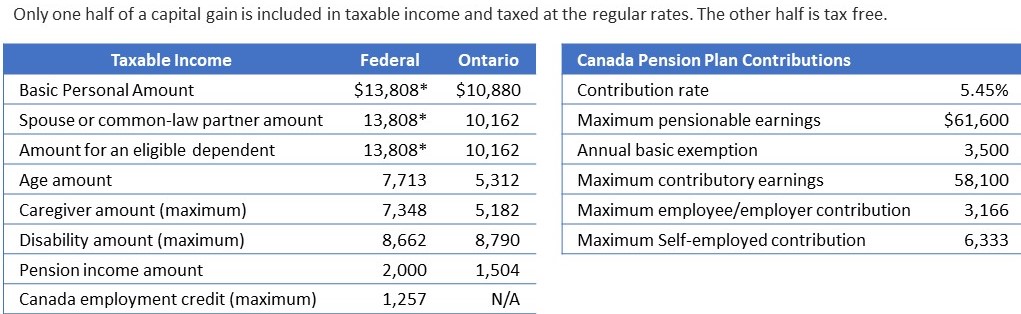

Tax rates are effective January 1, 2021, subject to government changes. Please be aware that these are approximate amounts.

Payment of Balances Owing

Balance owing is the amount you must pay by the due date. It Is important that you pay any amount that you owe to not face interest or late-filing penalties.

Corporations

Generally, the payment date is two months after the fiscal year ends (federal and Quebec). Three months after the conclusion of the taxation year for a CCPC that claimed the small business deduction in the current or prior year and whose taxable income on an associated basis did not exceed the $500,000 small business limit for that year (federal only).

Individuals must make their payments by April 30th of the following year.

Deceased individual

If the death occurred between January 1st and October 31st: The time to pay is April 30th of the following year.

If the death occurred between November 1st and December 31st: six months after the date of death.

Trusts

The time to pay is 90 days after the end of the taxation year.

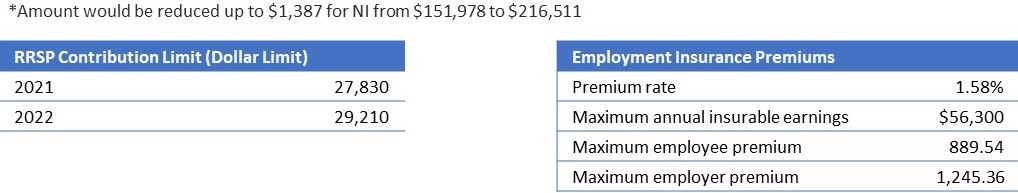

Prescribed Interest Rate

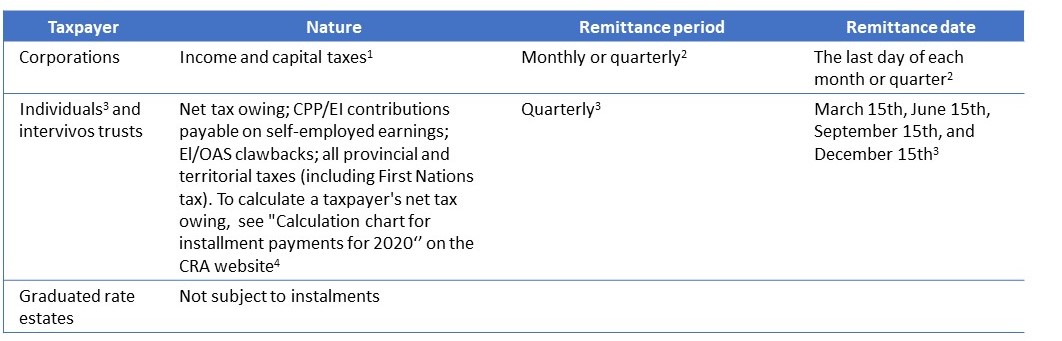

Instalments

Retention Period of Books

In general, all required records and supplementary documents should be retained for 6 years from the end of the most recent tax year.

If the CRA wants to keep a record for more than 6 years, the CRA staff will notify you directly or by registered mail how long the record must be kept.

If your income tax return is delayed, you will need to keep a record for 6 years from the date of your tax return.

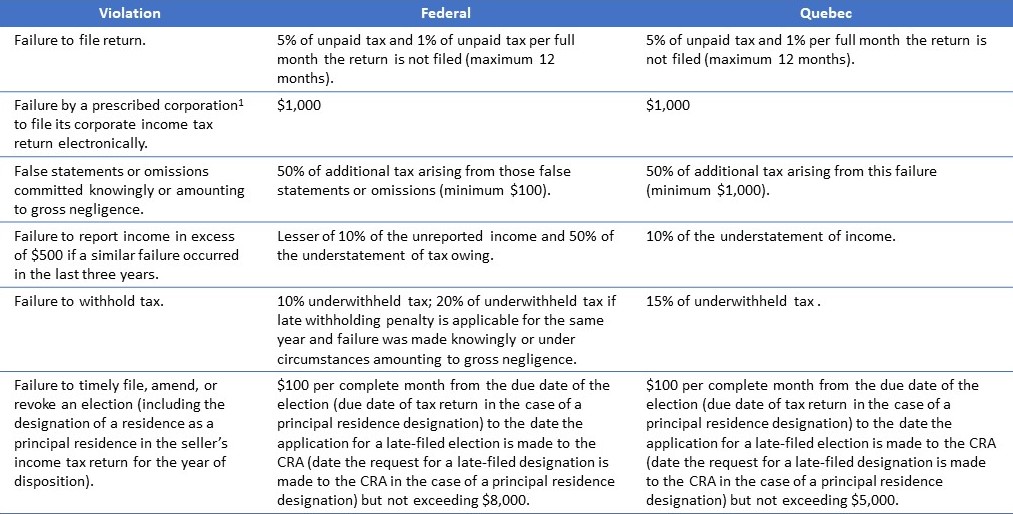

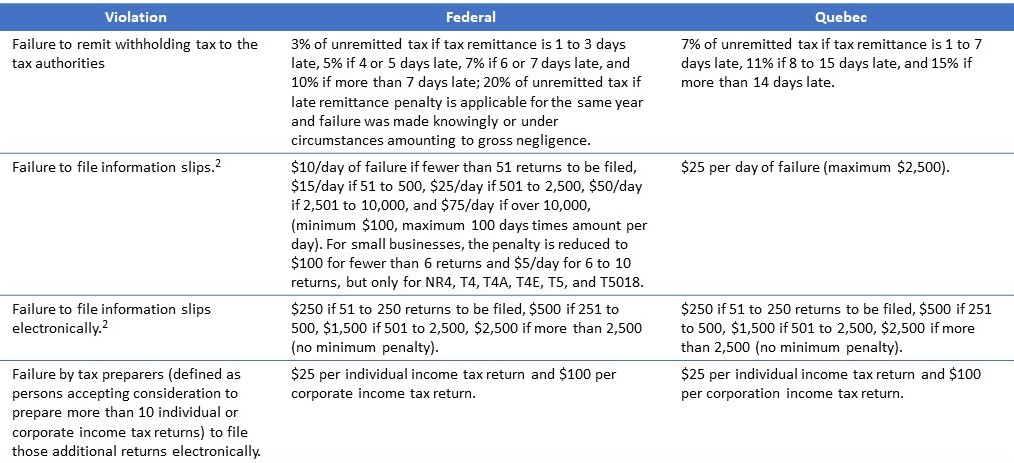

Major Tax Penalties and Offences

Deadlines

Filing the return of an Individual.

– April 30th of the following year.

Filing the return of an individual who carries on a business or whose cohabiting spouse or common-law partner carries on a business.

– June 15th of the following year

Filing the return of a deceased Individual not carrying on a business and whose cohabiting spouse or common-law partner did not carry on a business.

– If the death occurred between January 1st and October 31st: April 30th of the following year. If the death occurred between November 1st and December 31st: six months after the date of death.

Filing the return of a deceased individual who carried on a business or whose cohabiting spouse or common-law partner carried on a business.

– If the death occurred between January 1st and December 15th: June 15th of the following year. If the death occurred between December 16thand December 31st: six months after the date of death.

Filing the return of a corporation

– Six months after the end of the taxation year.

Filing the return of a trust or an estate.

– 90 days after the end of the taxation year.

Objection to a notice of assessment by a graduated rate estate or an individual other than a trust.

– The later of the following dates:

– One year after the filing-due date of the taxpayer’s income tax return; or

– 90 days after the sending dale of the notice of assessment (federal form: T400A; Quebec form: MR-93.1.1-V).

Objection to a notice of assessment by any other person.

– 90 days after the sending date of the notice of assessment (Quebec form: MR-93.1.1-V).